Please allow us to collect data about how you use our website. We will use it to improve our website, make your browsing experience and our business decisions better. Learn more Learn More

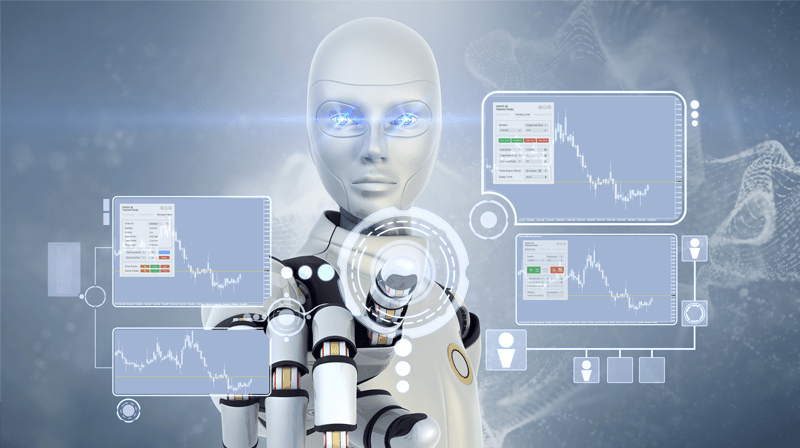

Stock Trading

How does stock trading work? Stock trading is the buying and selling of a company’s shares with an aim to make a profit. When you buy shares in a company you own a small part of that company, and the value of your investment will change as the company’s share price moves up and down. Investors use information including company news and announcements, company results (earnings), and technical analysis to make decisions about which stocks to buy and when. Once you’ve bought your investment you can log in anytime to monitor it and check the latest news and announcements. There’s no limit on how long you can hold your investment, and when you’re ready to sell simply login and click to sell instantly. You could then use that cash to make a new investment or return it to your bank Account.

Select any of Our Trading Packages